Remote Sensing and Index Insurance: Finding a Common Language

by Bristol Powell & Helen Greatrex, Financial Instruments Sector Team

Satellite products could give index insurance projects the scaling power they seek, but challenges remain. A workshop held earlier this year addressed these challenges head on.

Index insurance is innovative, but can it reach a critical mass? Until recently, many have doubted that index insurance could scale to the large numbers of farmers needed to address poverty. This is partly because of the sparse coverage of weather station networks in many parts of the tropics. Seasonal rainfall can vary over very short distances, so it is difficult for index insurance to sustainably scale if it only works in areas covered by existing rain gauges with long, continuous historical records. Rain-gauge based insurance design continue to face many challenges, including:

- How to make gauges tamper proof

- Creating back up plans in case of malfunction

- Addressing missing or corrupted historical data

- Installing new mobile technology installed to receive rainfall measurements quickly

- Offering insurance only to farmers whose on-farm weather conditions are represented by the weather at the gauge.

Satellites are addressing some of these challenges, allowing index insurance to reach a much wider audience. In recent years, many projects have turned to satellites to solve these problems. There are many remotely sensed products available, using custom scientific sensors on board satellites to determine rainfall, soil moisture and even plant health. An advantage of using satellite products is that they provide detailed coverage over a large area often going back more than 30 years. Satellites products are also generally freely available and are a tamper-proof, independent data source.

Farmers in Silika Village, Malawi discuss low rainfall years and compare their recollections with low rainfall years estimated by satellites. Photo: Bristol Powell/IRI.

Hundreds of thousands of farmers in Africa are now insured under indices based on satellite-derived rainfall estimates. For example, the R4 Rural Resilience Initiative currently insures 32,000 poor smallholder farmers using satellite based rainfall and vegetation information. Commercial companies such as ACRE, the Ghana Agricultural Insurance Pool and PlaNetGuarantee are also investing heavily in satellite-derived indices, covering hundreds of thousands of farmers.

Despite these advantages, using satellites for index insurance is not without challenges. Which dataset should we choose to best link with farmer’s losses? How do we deal with missing data? How do we understand the spatial variability of the satellite measurements and find ways to computationally process the large amount of data provided by a satellite? To complicate the situation further, remote sensing has many roles within insurance design. Some products are useful for creating the index directly, whereas others are more useful for validation, or for monitoring an agricultural season in real time.

Satellite-derived estimates of rainfall, soil moisture or vegetation are complicated products. They are typically created and curated by the academic research community.

The research and business communities can’t go it alone. In order to address all of these issues, we need an unprecedented collaboration between researchers and the private sector. Building effective communication and a shared language between these two groups is an essential step in making sure that satellites are used properly within index insurance.

With this in mind, remote sensing data providers, international reinsurance companies and index insurance project leaders held a workshop in February at the University of Reading, U.K. The event was hosted by the TAMSAT satellite rainfall group and the International Research Institute for Climate and Society. Participants highlighted exciting new developments in satellite datasets, built a shared vocabulary and language between different groups, fostered new collaborations and discussed crucial issues of satellites within index insurance.

Artist’s rendition of the MeteoSat-8 satellite. A Meteosat geostationary satellite has been active over Africa since the year 1980. The current satellite is Meteosat2, which takes infrared images of clouds over Africa every 15 minutes. These images lie at the heart of all satellite rainfall estimates for the tropics. You can see the images in real time here. (Image: EUMETSAT)

Representatives from major reinsurance companies HanoverRe and SwissRe attended as did those from large-scale insurance projects such as the R4 Rural Resilience Initiative, Pula Consulting and the Ghana Agricultural Insurance Pool. They were joined by remote sensing scientists from the University of Reading, the University of California Santa Barbara, Columbia University, the University of Maryland and others. As many of these remote sensing products are already being used in operational insurance programs, it was a great opportunity to share experiences.

We discussed several topics in detail, including:

- The most important roles and characteristics of a remote sensing product for index insurance and the common language that could be used to describe them

- The creation of a common protocol for missing data in insurance design

- Issues surrounding spatial and temporal scale. For example, as highlighted by the Ghana Agricultural Insurance Pool (GAIP), an insurance project attempting to use satellite observations to capture high severity, low frequency events (i.e. drought) may require a satellite which reports less frequently than a project insuring for floods, because the spatiotemporal characteristics of the event itself affect the requirements from the data.

What became very clear through discussions at the workshop is that a wide variety of satellite datasets could provide useful information to the index insurance industry. In addition to knowing how to select the best dataset to design an insurance contract, actors in the index insurance community must understand the characteristics of different satellite products and therefore, how different approaches to observing environmental information can inform the design, validation, and seasonal monitoring required for weather-based index insurance programs. The workshop is discussed in more detail in this Bulletin of the American Meteorological Society article. Outputs from the workshop have also been crucial in the development of an upcoming practitioners guide to satellites for index insurance

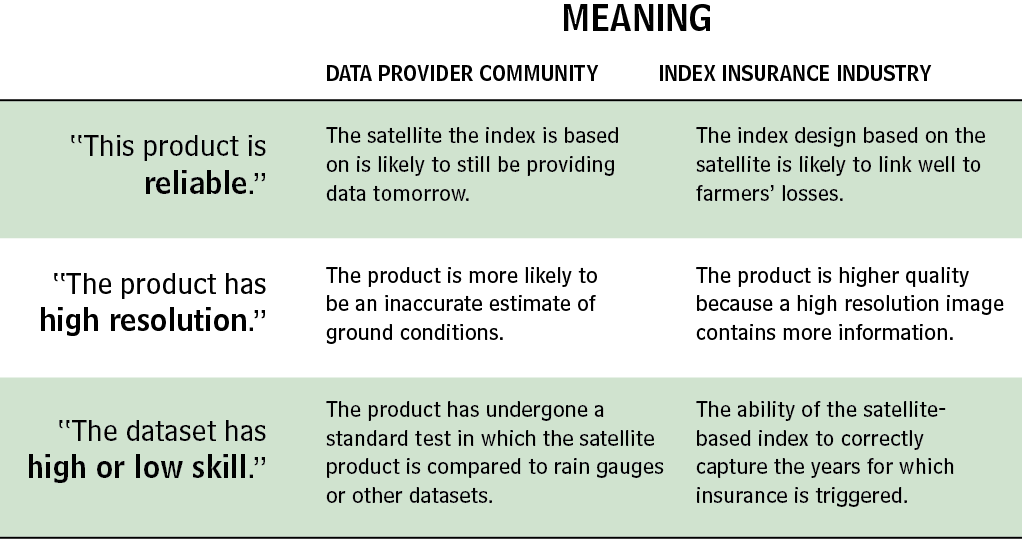

An agreed-upon, shared language is absolutely essential. Because multiple perspectives were represented at the workshop, the sessions were able to find a common vocabulary and begin a relationship of increased mutual understanding. This will foster future communications between data providers and the greater user community.

The workshop was co-funded between the CCAFS Theme 2 Flagship Programme, CASCAID, the National Centre for Atmospheric Science (NCAS) and the TAMSAT-led SatWIN-scale project, funded by the UK Natural and Environmental Research Council (NERC) PURE programme.

Further Reading

Report: Using Satellites to Make Index Insurance Scalable

For Farmers, Insurance is an Investment in the Future

25,000 Insured Ethiopian Farmers Receive Payments for El Niño Droughts

You must be logged in to post a comment.