ACToday Columbia World Project enabling insurance to reach a million farmers in Ethiopia

The Adapting Agriculture to Climate Today, for Tomorrow Columbia World Project (ACToday) has been working with its Ethiopian partners to create new climate tools for decision makers working in agriculture and food security. These investments are now directly enabling the World Food Programme (WFP) to reach its 2022 target of providing a million smallholder farmers in Ethiopia with affordable insurance against droughts and other climate risks.

The new target is part of WFP’s goal to scale up its R4 Rural Resilience Initiative, which helps farming communities increase their food security and income by managing climate-related risks.

In 2009, Oxfam America, in collaboration with the International Research Institute for Climate and Society and other partners, launched the Horn of Africa Risk Transfer for Adaptation (HARITA) project in one village of 200 farms in Ethiopia.

HARITA transitioned to R4 when the World Food Programme became involved. Today, R4 reaches nearly 90,000 farms in Ethiopia, Kenya, Malawi, Senegal, Zambia and Zimbabwe, supporting them to diversify their livelihoods, increase their savings and get access to microcredit and affordable index-based insurance. In 2018, participating farmers received nearly $1.5 million of insurance payouts to compensate for weather-related losses.

The Ethiopian government ultimately wants all of its vulnerable farmers to be covered by insurance. During times of drought, insurance helps farmers and their families keep food on the table. In non-drought years, insurance coverage helps farmers feel safe to take out loans to buy fertilizer and other inputs that can significantly increase their yields.

“If all of Ethiopia’s vulnerable farmers could be reached by insurance, this could totally change the landscape for food security,” said economist Dan Osgood, who leads ACToday’s insurance work. “R4 is a highly visible and successful project that has already helped large numbers of farmers improve their savings and wealth. We’re excited to help WFP reach hundreds of thousands more.”

Osgood said many index insurance projects have languished over the past decade primarily because they have a top-down approach that ineffectively uses technology and isn’t designed with enough farmer participation. “We’ve seen it happen time and time again.”

ACToday’s work in Ethiopia is making it possible to avoid these pitfalls, he said.

The project has worked with the country’s national meteorological service and agriculture sector to create new climate services for decision making, train staff to first learn how to use these new services and then be able to train their colleagues. With these new climate services in place, insurance projects such as R4 are now able to build tools specifically to help them scale.

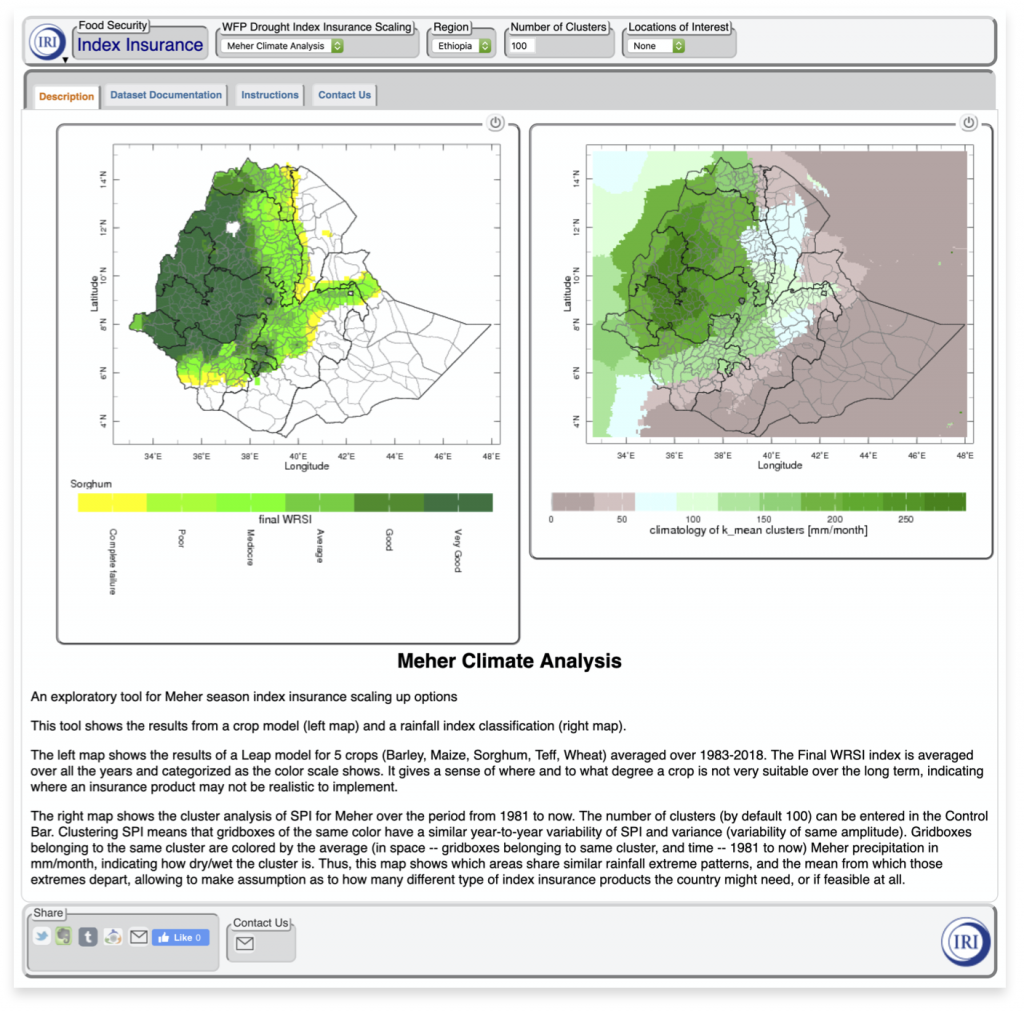

For example, a new maproom (see image below) powered by IRI’s Data Library is enabling WFP to identify and prioritize which areas R4 should invest in as it expands within the country.

“Before, we would decide this by where the poorest farmers are living, but these aren’t necessarily the places where insurance would have the most benefit for the most people,” said IRI’s Rahel Diro, an index insurance expert working on R4. “The new maproom helps us instead to identify areas where a given crop has the potential to be viable, and therefore where providing insurance makes the most sense.”

The tool also helps partners visualize rainfall patterns and extremes over wide areas, allowing them to pool insurance contracts for multiple areas based on these patterns, as opposed to making different contracts for each area, said Diro. It also enables users to optimize insurance parameters through comparisons of climate datasets and datasets crowdsourced directly from thousands of farmers.

Farmers at the core of a participatory design process

“Farmers are the only ones who truly know their opportunities, and whether or not the meteorological data on which the index insurance is based is reflecting their crop losses,” Osgood said.

“They must have a solid understanding of what the insurance is good for, and where they’re left exposed, or else they will make unsafe choices. That’s why we’ve always kept farmers at the center of the insurance design system, to harness the collective intelligence of the system.”

Doing this is difficult enough for a project serving a few hundred farmers. At a scale of millions to tens of millions, it becomes impossible without help from technology-based, iterative design, with the farmer “crowd” at its core.

ACToday is enabling farmers to stay at the center of the design process by supporting the development of a platform that will allow farmers in each village to use phone technology to participate in the design and verification of the satellite-based insurance for their village. Farmers could provide information via text messages, forms, phone apps, or by pressing numbers in response to questions asked in local languages. All this takes place in structured village ‘town hall’ exercises where participants reconcile the satellite data with their collective experience.

“We’re also researching the strengths and weaknesses of this system, to avoid approaches that might be ineffective or that leave out the voices of women or marginalized farmers,” said Osgood.

Plans are now underway to adapt a similar approach in Senegal, where both R4 and ACToday are working to improve food security.

This work was implemented as part of the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), which is carried out with support from CGIAR Trust Fund and through bilateral funding agreements. For details please visit https://ccafs.cgiar.org/donors. The views expressed in this document cannot be taken to reflect the official opinions of these organizations.

You must be logged in to post a comment.