2021 ACToday Highlight: Helping Provide Insurance to a Million Smallholder Farmers

This story was published as part of the Adapting Agriculture to Climate Today, for Tomorrow (ACToday) Columbia World Project 2021 Report. Read the full report here.

Since its launch in 2017, ACToday has invested in forecasts, monitoring tools and other information products to help government agencies, humanitarian organizations and farmers better plan for droughts and other climate-related threats to food production.

These tools, which are an important component of climate services, are now directly enabling the World Food Programme (WFP), winner of the 2020 Nobel Peace Prize, to reach its target of providing a million smallholder farmers in Ethiopia with affordable index-based insurance against droughts and other climate risks.

Index insurance is an innovative, affordable type of insurance that’s tied to a measurement of weather, such as rainfall estimated by satellites or recorded at a local weather station. If the amount of rainfall during critical stages of a crop’s growth cycle doesn’t reach a pre-specified threshold, farmers who purchased the insurance automatically get compensated without having to file any claims. This innovation has significantly lowered the transaction costs and risks for insurance companies, enabling them to keep premiums low and helping millions of farmers access coverage previously unavailable to them.

During times of drought, insurance helps farmers and their families keep food on the table. In non-drought years, insurance coverage helps farmers feel safe to take out loans to buy fertilizer and other inputs that can significantly increase their yields and income. Research by the International Research Institute for Climate and Society (IRI) and other organizations have shown that insured farmers in Ethiopia accumulated almost double the level of savings that their non-insured counterparts did, and also invested more in seeds, fertilizer and assets such as oxen.

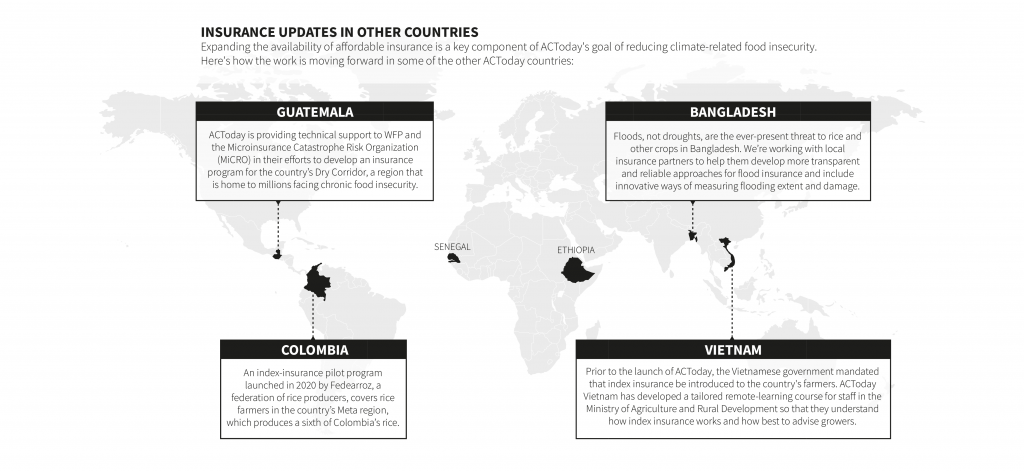

Both WFP and the World Bank are using ACToday tools to expand their index insurance programs in Senegal and Ethiopia (countries where ACToday is operating) as well as in Malawi, Zambia and Mozambique.

“ACToday helped us create the conditions for a major scale up in these countries by giving local insurance experts the capacity to design insurance products tailored to their area of coverage,” said Mathieu Dubreuil, Insurance Advisor at WFP. “This was an essential step that allowed us to expand into new regions and reach much bigger numbers of participants.”

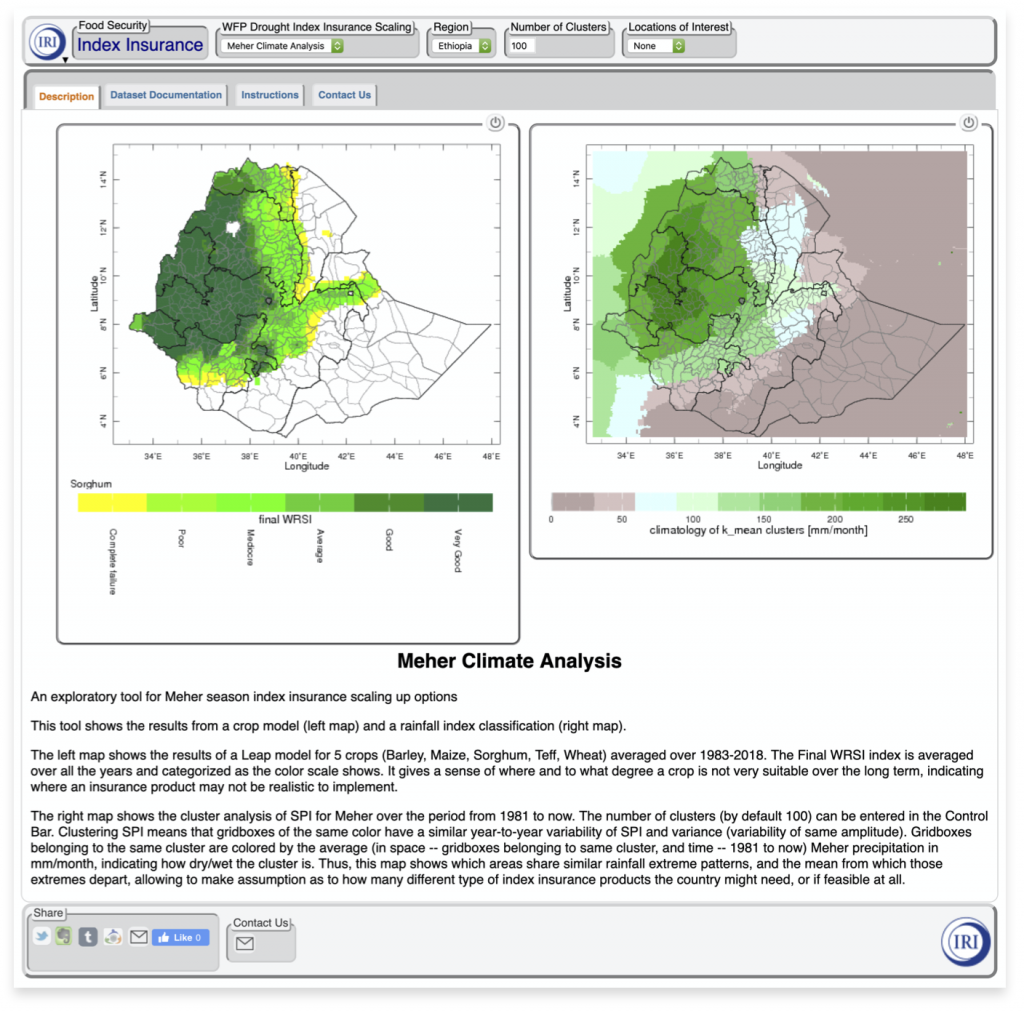

The design tool Dubreuil refers to is a new ACToday maproom–a mapping platform powered by the IRI’s Data Library. It helps insurance experts visualize rainfall patterns over wide areas, allowing them to pool insurance contracts for multiple areas based on these patterns, as opposed to making different contracts for each area.

“Previously, we would decide where to expand insurance based just on where the poorest farmers were,” said ACToday insurance expert Rahel Diro. “But these aren’t necessarily the places where insurance would have the most benefit for the most people. The maproom allows us to pinpoint these areas.”

“ACToday helped us create the conditions for a major scale up in these countries by giving local insurance experts the capacity to design insurance products tailored to their area of coverage. This was an essential step that allowed us to expand into new regions and reach much bigger numbers of participants.”

Mathieu Dubreuil, Insurance Advisor at WFP

Such a platform–which delivers crop information, high-resolution climate forecasts, historical rainfall data and satellite observations, all in real time–wouldn’t have been possible without the infrastructure and services ACToday built and continues to support through its collaboration with national meteorological services.

Keeping the Focus on Farmers

“We know from our decades of experience that index-insurance programs can’t scale up successfully if they don’t include farmers in the design process,” said Daniel Osgood, an economist at the International Research Institute for Climate and Society who is working on ACToday.

“Farmers are the only ones who truly understand their risks and opportunities, and whether or not the meteorological data on which the insurance index is based is accurately reflecting their crop losses,” he added. “They must have a solid understanding of which risks the insurance covers and doesn’t cover, or else they might make adaptation choices that would leave them unknowingly exposed.”

The process of working with farmers to develop responsible insurance products normally requires frequent community visits–a workable approach for projects covering a few dozen to a few hundred villages, but one that is too effort-intensive for projects that want to reach thousands or hundreds of thousands of farmers.

“We’re reducing the need for the insurance teams to visit every community, while still being able to crowdsource indispensable data from thousands of farmers.”

Daniel Osgood, IRI

Working with WFP and the World Bank in Senegal, ACToday has piloted new tools that allow farmers to use phone technology to participate in the design and verification of the index insurance being considered for their village. Farmers can share information via text messages, online forms, phone apps or by automated phone surveys asked in local languages. These tools are also, as part of ACToday, being tested across the Atlantic, in Colombia, where rice farmers in the Meta region are sending feedback to insurance providers working with Fedearroz, the country’s federation of rice producers.

“We’re reducing the need for the insurance teams to visit every community, while still being able to crowdsource indispensable data from thousands of farmers,” Osgood said. “This is also enabling insurance programs to continue despite the travel restrictions and other challenges brought on by the COVID-19 pandemic.”

You must be logged in to post a comment.