Financial Instruments Sector Team Launches New “Trade Blog”

The Financial Instruments Sector Team has launched a new publication on Medium, called Inside Index Insurance. The purpose of the publication is to provide a range of content types from team members – from quick dispatches from activities around the world to in-depth analysis of the technical components of financial instruments.

“I’ve always wanted to know more about what kinds of thinking goes on in other people’s projects—it’s so hard to tell from the reports and PowerPoints,” said Dan Osgood, research scientist and team lead. “This will hopefully be a great way for folks to see what we are thinking about as we work through things.”

Francesco Fiondella and Elisabeth Gawthrop of IRI’s communication team serve as editors for the publication. “The index insurance group has so much going on, we can’t keep up on our main IRI channels,” said Gawthrop. “This will help get more of their work out there, and provide an easier method for these scientists to directly explain their work to their audience. I also think it presents a unique opportunity for both narrative-driven and more technical, insider pieces — a kind of ‘trade blog’, if you will.”

One of the team members, Souha Ouni, recently wrote a piece about a new tool the team is developing. “It was delightful to write about what goes on behind the scenes and all the efforts that sometimes go unnoticed. As described in the blogpost, the tool we’ve developed shows so much promise, so stay tuned for more stories!”

See below for excerpts from Inside Index Insurance. An upcoming piece will explore the multiple realms of working in climate and development — from the international negotiations to talking to farmers in rural Senegal. If you have a Medium account, you can sign up to follow the publication and get notified when new posts are published.

New Tool Shows Promise For Index Insurance To Reach More Farmers

How can we keep getting vital farmer input to index insurance design while also expanding the insurance products to reach many more people? It’s been a lingering puzzle, but IRI staff have developed a new tool to improve efficiency in data collection — a key step to finding a solution.

Subsistence farming of maize, groundnut and millet dominates most livelihoods in Tambacounda, a region in eastern Senegal about the size of Denmark. The farmers are mostly from the multi-ethnic groups of Wolof, Pular and Serer, who have historically settled in the region and have adopted farming as their main occupation. Most farmers in Tambacounda don’t have irrigation, so their crops are dependent on rainfall, known as rain-fed agriculture.

If you visit during the dry season, you are most likely to see farmers gathered under the shade of a big eucalyptus tree, taking a well-deserved break after the harvest. They are shucking peanuts and drinking tea (called ataya) while chatting about this year’s yields of corn and millet. Gathered in bunches are cobs of maize that cover their low hut roofs, where they leave them to dry once the rainy season is over…[Read the rest]

Verifying Satellite Data with Farmer Reports

Index insurance uses satellite-based rainfall estimates to calculate how much money a farmer will receive in a drought. For index insurance to expand and reach more farmers, these estimates must be consistent with actual rainfall received by farmers. In 2016, rainfall reports from farmers in Ethiopia agreed pretty well with the index insurance satellite rainfall payouts. In this new animation, farmer rainfall measurements in Ethiopia are blue and satellite-based estimates are in yellow. Around 100 villages participated in this as part of the R4 Rural Resilience Initiative, which is led by the World Food Programme and Oxfam America.

“Check out how coherently you can see the main rainfall patterns sweep across the regions in the animation, evident for both the farmer and satellite — that’s what we need for index insurance,” said Daniel Edward Osgood, who leads IRI’s financial instruments sector team…[Read the rest]

How do we know when index insurance payouts are right? It’s not an easy question to answer.

There are a bunch of cool ways to use things like cell phones to get massive scale reports from farmers around the world.

But can you trust that data?

When we gather data from farmers about the effectiveness of index insurance, there are reasons for farmers to answer questions strategically to protect themselves: If your insurance company asks you if you didn’t really need a payout, what should you tell them?

If farmers answer strategically, can we know if #indexinsurance payouts are right, or even if people understand what they bought?

This will be really critical to nail if insurance is to scale for real…[Read the rest]

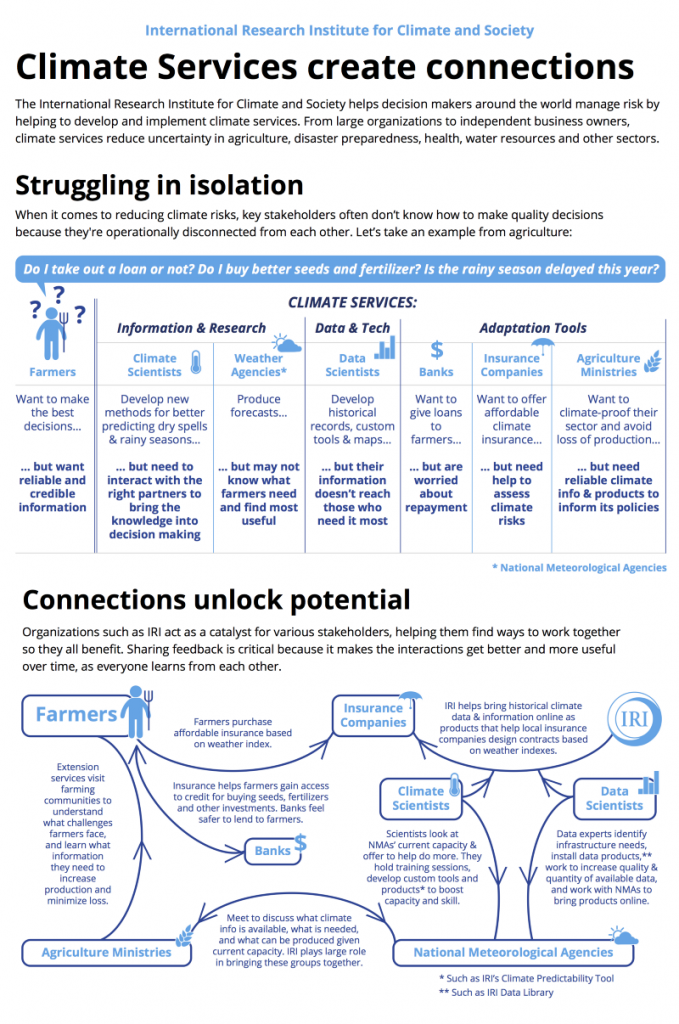

INFOGRAPHIC: What are Climate Services?

As climate services emerge as a new field of research and practice, what the field encompasses depends on who you ask…[Read the rest]

You must be logged in to post a comment.